Türkiye Rare Earth Elements Import and ExporT

Türkiye Rare Earth Elements import and export activity is becoming strategically important because rare earths are critical for magnets, batteries, electronics, aerospace and defense supply chains. In this article, we explain how Türkiye Rare Earth Elements import and export works in practice, how rare earths are classified, what the most commercially important elements are, and which permissions, controls, and potential quota risks companies should consider when trading these materials.

1) What Are Rare Earth Elements (REEs)?

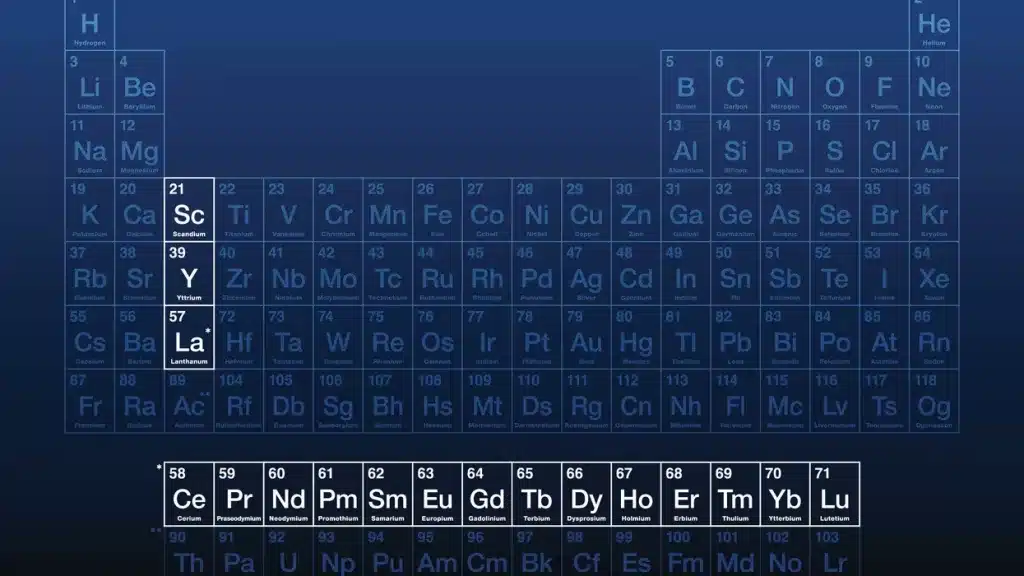

Rare Earth Elements (REEs) are a group mainly consisting of lanthanides (La–Lu) and also Scandium (Sc) and Yttrium (Y). They are called “rare” mostly because processing and separation are difficult, not because they are extremely scarce in Earth’s crust.

2) Classification of Rare Earth Elements (Light vs Heavy)

The most common commercial classification is Light REEs (LREEs) vs Heavy REEs (HREEs).

Light Rare Earth Elements (LREEs)

Typically includes: La, Ce, Pr, Nd, Pm, Sm

Market note: LREEs often exist in higher abundance and are more commonly traded in bulk oxide/carbonate forms.

Heavy Rare Earth Elements (HREEs)

Typically includes: Y, Eu, Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu

Market note: HREEs are often more supply-sensitive and higher value in specific applications (magnets, lasers, specialized alloys).

3) Rare Earth Elements Overview Table (Commercially Important Ones)

Below is a practical “trade-focused” table. I separated them into LREE/HREE and included why they matter commercially.

Tip: Buyers often trade REEs as oxides, carbonates, or mixed concentrates rather than pure metals (because separation technology is complex).

| Group | Element | Common Form in Trade | Key Properties (Why it matters) | High-Value Applications |

|---|---|---|---|---|

| LREE | Neodymium (Nd) | Nd₂O₃ | Enables very strong permanent magnets | EV motors, wind turbines, robotics |

| LREE | Praseodymium (Pr) | Pr₆O₁₁ | Improves magnet performance and heat resistance | High-temp magnets, aircraft |

| HREE | Dysprosium (Dy) | Dy₂O₃ | Adds high-temperature stability to magnets | EV traction motors, defense systems |

| HREE | Terbium (Tb) | Tb₄O₇ | Critical additive for high-performance magnets | Advanced motors, sensors |

| HREE | Yttrium (Y) | Y₂O₃ | Thermal stability, ceramics performance | Lasers, ceramics, coatings |

| LREE | Cerium (Ce) | CeO₂ | Polishing & catalytic properties | Glass polishing, catalysts |

| LREE | Lanthanum (La) | La₂O₃ | Catalytic & optical behavior | Catalysts, specialty glass |

| HREE | Europium (Eu) | Eu₂O₃ | Luminescent behavior | Displays, specialized lighting |

| HREE | Erbium (Er) | Er₂O₃ | Optical amplification ability | Fiber optics, telecom |

| HREE | Ytterbium (Yb) | Yb₂O₃ | Laser-related performance | Industrial lasers, advanced optics |

My trade opinion:

If you want “fast demand + best margins”, the top commercial interest typically centers on Nd, Pr, Dy, Tb (magnet supply chain). This is also why REEs are discussed in strategic/critical mineral programs globally.

4) Türkiye Import Side: How REEs Enter the Country

In practice, Türkiye Rare Earth Elements import and export begins with import because most industrial users require stable supply of:

- REE oxides (e.g., Nd₂O₃, Dy₂O₃)

- Mixed rare-earth compounds

- Concentrates and intermediate materials

Import process (typical flow)

- Correct HS/GTIP classification (12-digit GTIP used in Türkiye)

- Commercial invoice + packing list + certificate of origin (if needed)

- Customs declaration + any required conformity/chemical compliance

- Delivery to free zone or domestic warehouse depending on the trade model

REE chemicals are often handled like other industrial chemical inputs, so correct classification and documentation quality is critical.

5) Türkiye Export Side: How REEs Are Exported (Practical Steps)

Exporting REEs from Türkiye can occur as:

- Processed materials (oxides / compounds)

- Mineral concentrates (if available)

- Potentially value-added intermediate products in the future (separated oxides / magnet materials)

Typical export flow

- Define the product precisely (oxide? metal? mixture?) and match GTIP

- Check export regime restrictions (controlled goods / dual-use potential)

- Customs export declaration + logistics (ADR/IMDG if hazardous classification applies)

- Buyer compliance (especially EU/US customers can request extra due diligence)

The Ministry of Trade provides official information on export-related regimes and procedures (including export facilitation mechanisms like Inward Processing, used broadly by exporters).

6) Licenses, Permissions, and Compliance in Türkiye (Export Control Reality)

A) “Mining permit” vs “Export permit”

There are two different realities:

1) Mining / extraction permits (upstream)

If the material comes from domestic mining activity, it is tied to mining licensing + environmental rules and can be treated as a strategic mineral topic in policy discussions.

2) Export controls (trade-side)

Türkiye’s export side is typically governed by:

- Product classification (GTIP)

- Customs + trade regime

- Potential “strategic / controlled items” rules depending on material type & end use

My opinion: In REEs, the biggest compliance “surprise risk” is not normal customs—it’s end-use and buyer country scrutiny (especially magnets & defense-linked uses).

7) Are There Export Quotas for Rare Earths in Türkiye?

Short answer (most practical answer):

Türkiye does not publicly operate a widely-known, standard “rare earth export quota system” like some other countries are introducing.

However, REEs are increasingly treated as strategic minerals in global policy and supply chain security discussions, meaning trade conditions can tighten quickly depending on geopolitical pressure and domestic industrial policy.

What does exist in the real world?

- Sector sensitivity is rising (globally, REEs are moving into licensing/controls in multiple countries).

- Quota/permit models are becoming more common abroad (China-related licensing news is a good example of how quickly “free trade” can become “permission-based”).

My trade conclusion: Even if Türkiye does not apply quotas today, any exporter should build a compliance plan as if controls may tighten for strategic minerals.

8) What Products Are Actually Traded? (GTIP / HS reality check)

Most REE trade happens under chemical chapters such as:

- HS 2846 (compounds of rare-earth metals; mixtures of rare-earth oxides/chlorides, etc.)

In practice: correct HS/GTIP selection is one of the biggest “profit or problem” points in REE shipments.

9) Türkiye’s Strategic Position (Why this market matters now)

Türkiye has been emphasizing rare earths in terms of building a future value chain and processing capability.

This supports the idea that Türkiye Rare Earth Elements import and export may move from “mostly import” toward more balanced trade, depending on industrial processing capacity.

10) My Practical Trade Notes (What I would do as an exporter/importer)

If I were building a commercial REE trade line from Türkiye:

- Start with Nd/Pr oxides (magnet demand) + Ce/La (volume market)

- Use strict specs: purity %, particle size, moisture, radioactivity checks (if concentrate)

- Prepare for buyer requirements: MSDS, REACH-style documentation (esp. EU buyers)

- Build a “controlled goods checklist” even if not legally mandatory today

- Avoid vague product naming (“rare earth powder”) → customs risk